We offer a flexible line of credit that provides you easy access to liquidity and is secured by a pledge of diversified, non-retirement investment assets. Our lines of credit are delivered through a seamless online origination process and collateral management platform. We have a dedicated team of experienced bankers to help with product and service support.

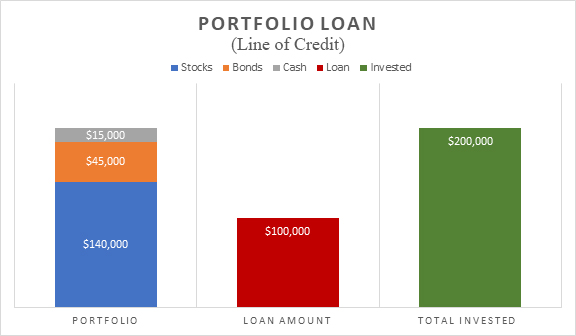

Margaret is a “Real Estate” entrepreneur and wants to buy an investment property for $100,000. The seller is entertaining “cash offers” only. Margaret calls Bobby (her investment advisor) about her options because she knows that this property will move off the market fast. Bobby reminds Margaret that she has a line of credit (connected to her portfolio) that can be used to wire the money to the real estate attorney’s escrow account within hours. Margaret was relieved that this lending-vehicle was established and followed Bobby’s advice to use it for her transaction.

- SIZE: Loans are offered from $75,000 to $25 million, with minimum draws of $2500

- TYPE: Revolving line of credit; clients can borrow, repay, and re-borrow multiple times

- TERM: No stated maturity date; Goldman Sachs has a right to demand payment of the loan at any time

- PRICING: Loan pricing is set as a spread plus 1-Month Term SOFR with spread determined by line amount; there are no fees

- ELIGIBLE ACCOUNTS: Account types may include individual, joint, trust, LLCs, and partnerships as a standalone or in combination

- DOCUMENTS: No personal financial statements, tax returns, paper applications or other documents required

- COLLATERAL: Collateral must be in the form of non-qualified assets such as stocks, bonds, mutual funds, or ETFs; the client executes a first lien pledge of collateral through a control agreement

- Business Needs

- Liquidity

- Business Expansion

- Start-Up

- Seed Funding

- Working Capital

- Acquisitions

- Life Events

- Education | Wedding Expenses

- Luxury Purchases

- Home Improvements

- Tax Payments

- Investment Real Estate Purchases

- Personal | Charity

Cannot be used to purchase or carry equities, bonds, mutual funds or other securities

Loans are offered by a New York State-chartered bank which is a member of the Federal Reserve System and Member FDIC.

Securities-based lines of credit may not be suitable for all loan parties (e.g., borrowers. pledgors, and guarantors) and carry a number of risks, including but not limited to the risk of a market downturn, tax implications if pledged securities are liquidated, and the potential increase in interest rates. You should consider these risks and whether a securities-based loan is suitable before proceeding.

Credit qualification and collateral are subject to approval. Additional terms and conditions apply.

Trulytics Financial does not provide legal, tax or accounting advice. This content is for marketing purposes only and is not a substitute for individualized professional advice. Individuals should consult their own tax advisor for matters specific to their own taxes and nothing communicated to you herein should be considered tax advice.

All Rights Reserved.